Trust Lawyers in Ottawa

for Strategic Estate Planning

Trusts are powerful tools for managing and protecting wealth—during your lifetime and beyond. Our Ottawa trust lawyers provide strategic legal advice to help you establish, modify, and administer trusts in a way that reflects your goals, safeguards beneficiaries, and ensures compliance with Ontario law.

Create peace of mind with a trust that reflects your intentions,

protects your assets, and benefits your loved ones.

Our experienced trust lawyers in Ottawa offer personalized legal guidance for the creation, administration, and structuring of trusts. Whether you are looking to minimize probate, provide for a loved one with special needs, or plan charitable giving, we tailor trust solutions that align with your estate and tax planning needs.

Trusts can provide control, flexibility, and protection for your estate plan. We are here to help you structure a trust that meets your specific goals, whether personal, family, or business-related.

- Types of Trusts

- Inter vivos (living) trusts

- Testamentary trusts

- Spousal trusts

- Family trusts

- Henson trusts (for beneficiaries with disabilities)

- Charitable trusts

- Insurance trusts

- Trust Planning & Administration

- Structuring trusts to minimize tax and probate exposure

- Advising trustees on their duties and obligations

- Drafting trust agreements and related documents

- Administering trusts according to Ontario law

- Managing beneficiary distributions

- Modifying or winding up existing trusts

- Cross-border or multi-jurisdictional trust planning

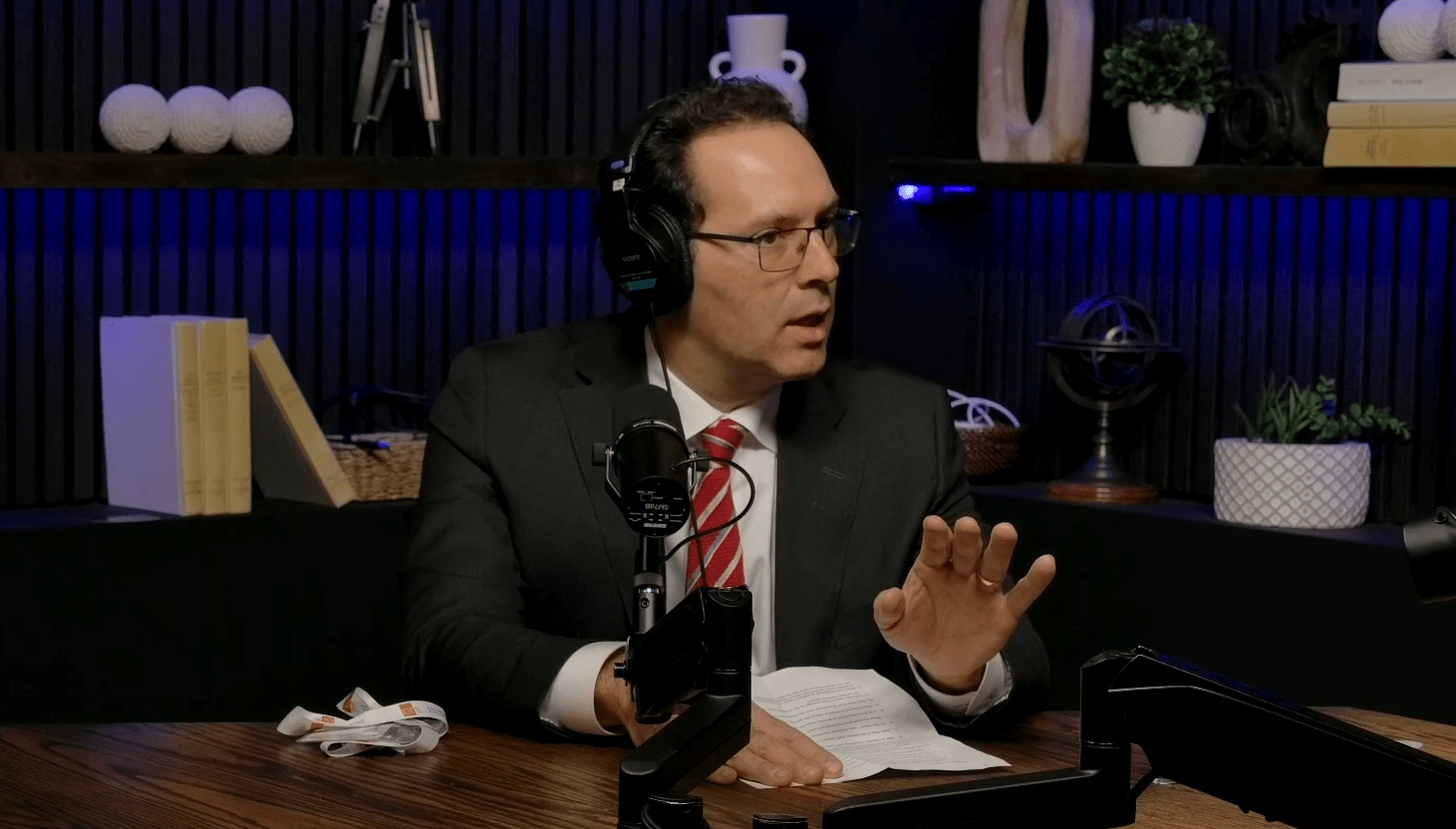

To learn more about how we can help you, please get in touch with Russell Gibson

Our Trusts Lawyers

Frequently Asked Questions

At Gibson Tanner Rabin LLP, we understand that navigating legal matters can be complex and overwhelming. Our FAQs are designed to provide clear, concise answers to common questions, helping you gain a better understanding of our services and processes.

What is a trust and how is it used in estate planning?

A trust is a legal arrangement where a trustee holds and manages assets for the benefit of one or more beneficiaries. Trusts can be used to control how assets are distributed, reduce probate fees, protect vulnerable beneficiaries, or achieve tax planning goals as part of a broader estate strategy.

What is the difference between a living trust and a testamentary trust?

A living (inter vivos) trust is created during your lifetime and can take effect immediately. A testamentary trust is created through your Will and comes into effect only after death. Each type has unique advantages depending on your goals, such as privacy, probate avoidance, or long-term management of assets.

Who can act as a trustee in Ontario?

A trustee can be a trusted individual, a professional (like a lawyer or accountant), or a corporate trustee. Trustees carry a fiduciary duty to act in the best interest of the beneficiaries and must manage trust assets prudently, transparently, and in accordance with the trust terms.

What is a Henson trust and when is it used?

A Henson trust is a specialized trust designed to benefit individuals with disabilities without affecting their eligibility for government support programs like the Ontario Disability Support Program (ODSP). It offers discretionary distributions, allowing the beneficiary to benefit without losing assistance.

Can a trust be changed or revoked after it's created?

Some trusts, like revocable living trusts, can be amended or revoked by the settlor during their lifetime. Others, such as irrevocable trusts, generally cannot be changed without court approval or beneficiary consent. Legal advice is important before establishing any trust structure.