Ottawa Wills Lawyers

for Confident Planning

A well-crafted Will is one of the most important steps in protecting your assets and providing peace of mind for your loved ones. Our Ottawa Wills lawyers ensure your wishes are clearly expressed, legally valid, and aligned with your broader estate planning goals.

A properly drafted Will helps your loved ones avoid uncertainty,

and ensures your legacy is distributed according to your intentions.

At Gibson Tanner Rabin LLP, we provide tailored legal advice on preparing Wills that meet your needs and comply with Ontario law. Whether your estate is simple or complex, we help you make informed decisions regarding executors, guardianship, property distribution, and more—so your voice is heard even after you’re gone.

Our team takes the time to understand your priorities and help you plan with clarity. We draft Wills that are legally enforceable, easy to understand, and built to withstand future challenges.

- Wills Preparation & Review

- Drafting simple and complex Wills

- Updating Wills after life events (marriage, divorce, children)

- Naming executors and alternate executors

- Appointing guardians for minor children

- Creating mirror Wills and spousal Wills

- Planning for blended families

- Property and asset distribution

- Digital asset and cryptocurrency clauses

- Incorporating secondary or backup Wills

- Reviewing and revising existing Wills

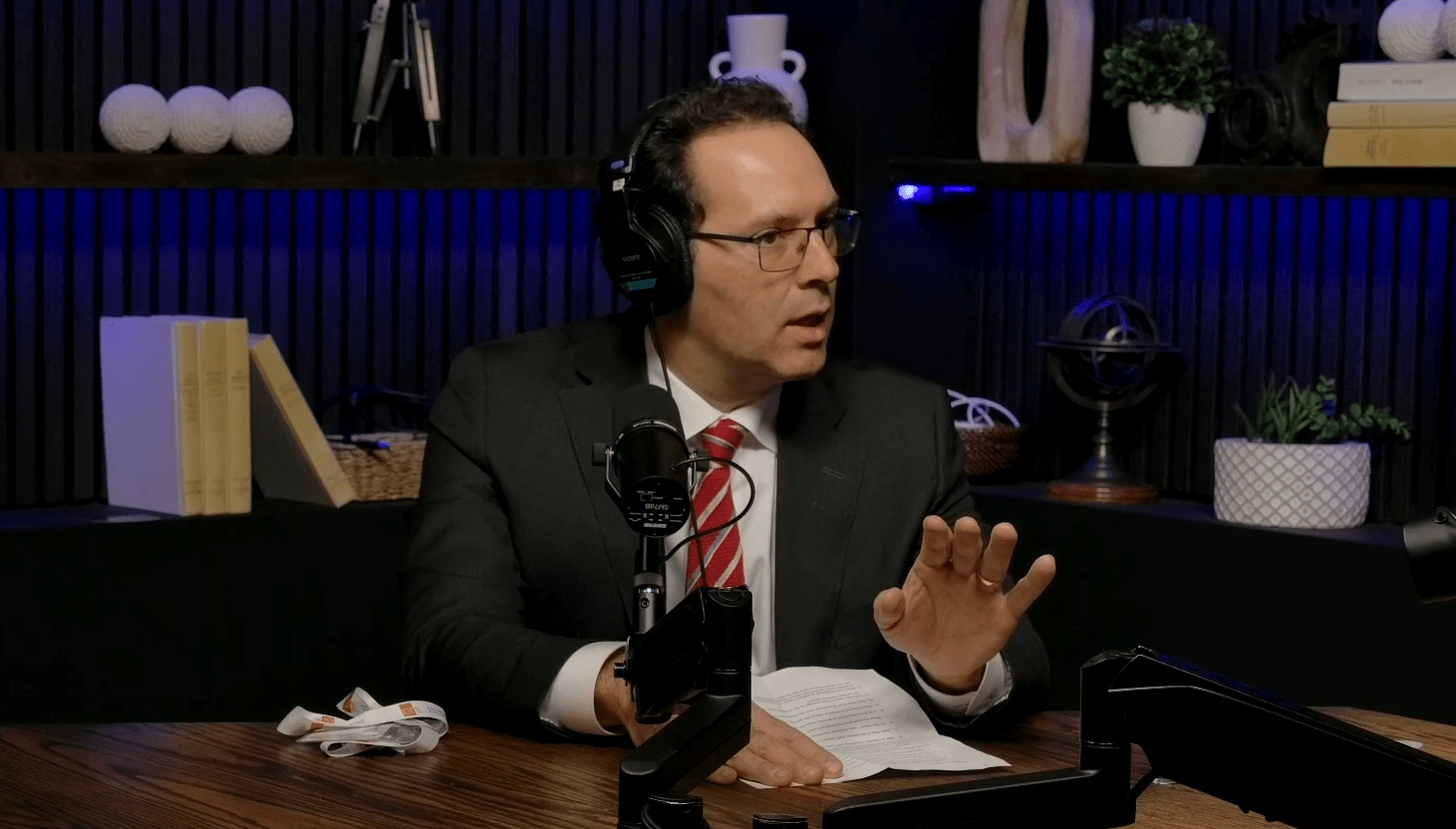

To learn more about how we can help you, please get in touch with Russell Gibson

Our Wills Lawyers

Frequently Asked Questions

At Gibson Tanner Rabin LLP, we understand that navigating legal matters can be complex and overwhelming. Our FAQs are designed to provide clear, concise answers to common questions, helping you gain a better understanding of our services and processes.

What happens if someone dies without a Will?

In Ontario, if someone dies without a Will (intestate), the assets are distributed according to the Succession Law Reform Act, which may not align with your preferences.

Do I need a lawyer to make a Will in Ontario?

While you can create a Will without a lawyer, legal advice helps ensure your Will is valid under Ontario law and less vulnerable to disputes. A lawyer can also help with complex family or financial situations, such as blended families, business ownership, or non-resident beneficiaries.

How often should I update my Will?

You should review your Will every few years, or after significant life changes such as marriage, divorce, the birth of a child, the acquisition of new assets, or the death of a named executor or beneficiary.

Can I change my Will once it's signed?

Yes. You can amend your Will through a codicil or by drafting a new Will entirely. It’s important to ensure the changes meet legal requirements so the new version is valid and enforceable.

What should I include in my Will?

Your Will should name an executor, outline how your assets are to be distributed, appoint guardians for any minor children, and specify any particular gifts or instructions. It may also address digital assets, charitable donations, or wishes for funeral arrangement